WingRight

Money and Finance

5th Circuit Upholds Texas Law on Funding for Women’s Health Program

Guess what? States are allowed to decide what they want to spend tax money on!

From the ruling by the Fifth Circuit Court on Texas’ Law prohibiting our Family Planning tax funds from going to any “affiliate” of an abortion provider or anyone who “promotes” abortion: ”

Although this restriction functions as a speech-based funding condition, it also functions as a direct regulation of the content of a state program, and is therefore constitutional . . . “[W]hen the government appropriates public funds to promote a particular policy of its own it is entitled to say what it wishes.” Rosenberger, 515 U.S. at 833 (citing Rust, 500 U.S. at 194).

Needless to say, the press, including the Texas Tribune and theAustin Chronicle disagree with this ruling, the latter more obviously than the former.

Once again, please look at the Texas Tribune’s own interactive map or the State’s data base of doctors and clinics who have contracted with Texas’ WHP. Those Planned Parenthood clinics aren’t located in health care shortage areas. There are no shortages of willing providers for the services in question in the areas surrounding the abortion affiliates.

Texas Medical Association wants you to pay for elective abortions @texmed @texasallianceforlife #pro-life #tcot

Not all of the members of Texas Medical Association agree with the TMA on this.

The San Antonio Express News published an editorial August 9th, by O. Ricardo Pimentel, entitled, “Texas tries to get between you, your doctor:”

For them, the issue isn’t abortion; it’s about the doctor-patient relationship, patient health and the ability to put everything on the table that needs to be discussed. Even if it’s abortion.

In a recent letter to the state, the Texas Medical Association, joined by other medical groups, said Texas is about to embark on a plan for providing medical care to low-income women that will impose a “gag order” on discussing abortion even on doctors working with patients not in the program.

Other groups, weighing in during the public comment period on proposed state rules, have similar concerns.

It’s a plan, they say, that will ensure not enough doctors for this program willing to provide care, including family planning services. And this, they say, will guarantee more unintended pregnancies, more abortions and more illness that might have been prevented for low-income women.

Among those also commenting on the rules were the Center for Public Policy Priorities, and leaders of Planned Parenthood entities in the state, South Texas groups among them.

Trust me, for everyone who is mentioned above, it’s about abortion. The law doesn’t stop anyone from discussing or even promoting true contraception that doesn’t end the life of our youngest children of tomorrow.

And it is about “elective abortions:” those that are performed on health babies in healthy mothers. We’re not talking about the more controversial abortions in cases of rape and incest, much less in the cases of congenital disorders that are “not compatible with life outside the womb and certainly not in cases where the mother’s life is in danger. Since when do elective abortions “need to be discussed?”

How difficult is it to understand that Texas taxpayers should not pay for “promotion” of abortion? Or that we most certainly do not want our State tax funds to go to doctors who perform elective abortions on healthy babies and healthy mothers?

While I don’t speak for the Society, I am an elected delegate for my County Medical Society to the TMA House of Delegates and I believe that most of our members would agree with me on this. I am very much in favor of restricting payment from our limited State funds to only those doctors and organizations that provide comprehensive and continuing medical care for the whole woman and her whole family. With Texas Family Doctors, Internal Medicine Docs, Pediatricians and OB/Gyns reeling from the lack of increasing fees from Medicare and decreases in Medicaid funding, why not help keep them in business by adding the availability of billing the State for screening tests like pap smears, exams for breast masses, diabetes and high blood pressure?

In fact, that’s what the Legislature decided: that money would be prioritized. First come the comprehensive care docs, hospitals, and county and city clinics. Planned Parenthood is never mentioned, although there is a section of the law that absolutely prohibits the State from contracting with anyone who “promotes” abortion *if there are other qualified providers available.*

Texas DHS has already identified more than enough doctors and clinics that qualify under the law. These doctors can actually treat the diseases for which the Texas Women’s Health Plan screens. Our Texas Legislature made a wise decision when they agreed that it doesn’t make sense to send our few dollars to a clinic that treats a very narrow medical spectrum in an intermittent manner.

And the law has already saved human lives: Austin city and Travis County taxes once paid for 400 elective abortions each year. A year ago, the law achieved what the taxpayers who protested this use of their money couldn’t do: Austin and Travis County health clinics were forced to stop funding those abortions.

If you have a family doctor, consider a polite call to his or her front desk asking them to let the TMA know their views on using Texas’ tax funds to support Planned Parenthood and other abortion providers.

You might also consider contacting Texas Alliance for Life and/or you local Crisis Pregnancy Center to let them know that you support their efforts to keep your State (and federal) tax funds from paying for the ending of lives of our Texans of tomorrow.

Action: Women Speak 4 OURSELVES @WomenSpeak2012 #tcot #pro-life

Based on the Declaration of Independence, the Constitution of our United States is designed to secure our rights to life, liberty and property for every human being, not just the ones who can speak out. Those of us who can speak, should join in the effort to protect the rights of all, including the unborn children of tomorrow, male and female, and everyone who objects to government-sponsored efforts to end their lives. The recent Obama mandate that infringes on the First Amendment protection of the right of free exercise of religion and their on-going efforts to force Texas to fund Planned Parenthood with State taxes is in direct violation of the Bill of Rights.

I received an email tonight from the group, “Women Speak for Themselves” asking for comments on next Saturday’s Washington, DC rally sponsored by pro-abortion, anti-family and anti-First Amendment rights groups:

This Saturday, on the National Capitol lawn, Think Progress (a George Soros funded group) is hosting a “We Are Women” rally. Soros’ group, along with some of their co-sponsors, the usual—the National Organization of Women, Planned Parenthood, and the National Women’s Political Caucus—along with some more peculiar groups—Rock The Slut Vote, The National Center for Transgender Equality, and the Reformed Whores entertainers, among others—have a specific goal in mind.

“Our mission,” their website reads, “is to bring national attention to the ongoing war on women’s rights…”

Not surprisingly, the language on their website gives the appearance that they’re claiming to speak for all women on matters of healthcare, family, and freedom…which makes this just the type of event at which we need to make our voices heard! And so, here’s where YOU come in.

Prior to the rally, we’ll be releasing a statement to the press, informing them that there are women with alternative views on these matters, should the press wish to include us in the discussion. We’d like to add YOUR voices to that statement.

Send us a brief statement (2-3 sentences), articulating why as a woman you stand for and believe freedom includes protection for life, family, and/or religion. Be sure to include your full name, city and state, and your occupation, if you’d like—along with permission for us to include your information and quote in our press release.

If you’re not sure where to start, feel free to use our two sets of talking points for ideas (though your statement need not be solely focused on the HHS mandate), and try to stay focused on why you’re FOR our view of women’s freedom, as opposed to AGAINST the view of women’s freedom being put forth by Soros and cohorts.

Thanks for your help with this….I look forward to your statements!

My best to you,

Helenhttp://womenspeakforthemselves.com/

https://www.facebook.com/WomenSpeakForThemselves

https://twitter.com/womenspeak2012P.S. I’m told some pro-lifers will be gathering at the North Capitol Lawn on Saturday, to hold a counter protest. The rally starts at 11am, I believe, so feel free to head on over, with signs and pro-life gear, if you’d like to be a joyful example of the alternative.

I wish I could attend the counter protest, but I’m committed to a meeting for the Christian Medical and Dental Association that day. If you can attend, please do. Either way, send a message to http://womenspeakforthemselves.com/ or @womenspeak2012!

Rush Rules, Again! @MittRomney #taxes #tcot

From Rush’s transcript, August 2, 2012,

RUSH: Now, ladies and gentlemen, Mitt Romney is no tax cheat. But even if he was, so what? The Treasury secretary of the United States is an admitted tax cheat, and the Democrats didn’t give a damn about that. Harry Reid and his fellow Democrats in the Senate voted to confirm Little Timmy Geithner, the tax cheat. Joe Biden is a plagiarist. Anybody care about that? Barack Obama fudged laws in a shady deal to buy his house with the help of a conflicted felon. His good pal Bill Ayers bombed the Pentagon. Romney is none of this. Not even close to it. We have an admitted tax cheat that is the Treasury secretary of the United States, Timothy Geithner. Democrats don’t care about it.

Politifact Texas calls @DonnaCampbellTX tax scare “Pants on Fire!” #TxSen

Dr. Donna Campbell is in the runoff election for Senate District 25 against pro-abort “Hairy-legged male,” incumbent Jeffrey Earl Wentworth.

Hairy, uh, Jeff has pulled out some statement about the Fair Tax or Flat Tax that Donna may have made years ago,adds in some testimony about a Texas sales tax that Donna commented on other to say she’d consider it if it lowered taxes, and claims that Dr. Campbell would back a 35% sales tax. Politifact Texas has evaluated that claim and not only is it “False,” it’s a “Pants on Fire’ lie.

What you might not know about the Texas US Senate Race #TxSen

At Monday night’s debate in Houston between Lieutenant Governor David Dewhurst and Ted Cruz, Republicans in the runoff for the US Senate race(Twitter #TxSen), I met a couple who said they were still “undecided” about who to vote for. They asked why I was supporting Lt. Governor David Dewhurst over Ted Cruz. They were surprised that I believed his record is so strong and hadn’t even heard about Ted Cruz’ speculation to reporters that Governor Perry wanted to get Lt. Governor Dewhurst elected because he wanted Dewhurst out of Austin. The fact that these two went to the effort to attend a debate on a Monday night made me believe that they are actually informed voters, but that if these two people don’t know the issues, perhaps many others don’t either.

I’ve covered some of this in other posts on WingRight, including my last Post, “An Open Letter to Texas Voters,” and you can read about the support David Dewhurst received from 18 of the 19 Republicans in the 31 member Texas Senate, here. Here are more specific reasons why I support pro-life, pro-marriage, small government candidate Lt. Governor David Dewhurst for US Senator from Texas.

As I’m sure you know, Texas has a quirky system, where our Lieutenant Governor is more powerful than our Governor in many respects. If you want to know what Lt. Governor Dewhurst will do in the US Senate, look at just some of the laws he’s helped pass over the last 10 yrs:

- Women’s Right to Know Act, an informed Consent law for abortion with 24 hour waiting period, 2003;

- Prenatal Protection Act which declared the unborn an “individual” – a person in Texas law – “from fertilization until natural death,” 2003,

- Defense of Marriage Act, 2003, with a Second law passed to amend our State Constitution, 2005;

- Parental consent for abortion, 2005;

- Tort reform, 2005;

- Decreased school property tax by 1/3, 2007;

- Jessica’s Law, 2009,

- Loser Pays, 2011;

- De-funded abortionists, including Planned Parenthood, 2011;

- Prohibited illegal aliens from getting driver’s licenses, 2011;

- Photo Voter ID, 2011;

- Blocked the law written specifically to force Texas to follow the Democrat’s call to raise school spending at 2009 stimulus levels, 2011;

- Sonogram Bill, requiring the abortionist to offer the mother a chance to see her child and hear the heartbeat;

- Castle Law 2009 that allows Texans to use deadly force to defend themselves against threats, without having to prove they tried to “retreat”to safety;

- Stronger protection for Concealed Carry Permit holders every session since 2003:

- Balanced our budget every two years, even when there were projected shortfalls in 2003, 2009, 2011;

- Every year since 2005, Texas has spent at least $100Million of our tax dollars to augment border security and that number was doubled in 2011.

Governor Perry, with the help of Lt. Gov. Dewhurst and the Texas Senate, refused to accept those “Stimulus funds” for education and unemployment insurance that would have forced us to change our laws in 2011. Yes, we used some stimulus funds that didn’t require us to change our laws, but, as our former Senator, Phil Gramm said,

“(I)f the Congress had a vote on whether to build a cheese factory on the Moon, I would oppose it based on what I know now, and I cannot imagine the circumstance under which I would support it. But on the other hand, if Congress in its lack of wisdom decided to start a cheese factory on the Moon, I would want a Texas firm to do the engineering, I would want a Texas construction firm to do the construction, I would want the milk to come from Texas cows, and I would want the celestial distribution center to be in Dallas, Texas, or College Station, Texas, or somewhere else in my State.”

These are just the highlights of a career that began the same year that 11 Democrat Senators left Austin on a supporter’s plane in order to hide out in Albuquerque New Mexico for a full month in order to deny the Senate a Quorum and avoid losing the votes on Congressional redistricting.

You might have read that Dewhurst increased taxes, with the misleading statistic that our revenues went up over the last 10 years. Increased revenues do not necessarily mean increased taxes! They also go up with the growth of the economy. Texas’ population went up over 20% and our State added more jobs than all the other States combined in the same time period. These were good jobs, and they went to legal residents who come into our State at the rate of 1000 people a WEEK! The fact is that even the Club for Growth, who is now backing Mr. Cruz, stated last year that Texas’ spending has actually gone down over the last 10 years, when adjusted for population and inflation.

How did we spend that money? Mr Cruz knows exactly how: he was the lawyer who worked out a deal in Federal Court when he was Solicitor General that bound the State to increase spending on Medicaid. He uses this spending from his agreement against the Lt. governor.

You might also read that Dewhurst supported a “payroll tax,” or even an “income tax.” These accusations are based on words in a press release and an editorial against the Lt Governor, from 2006. These weren’t the words used in the Bill that is bandied about, and that Bill never became law. In the law that was eventually passed, there are three ways to calculate our State business franchise tax. One of those is a tax based on employee pay, minus benefits. But there are two other ways, and the business chooses the best way for them. More telling is that our Attorney General won the case proving that the tax is not an income tax, last November. Cruz knew that his claim was wrong as from the beginning of his ads and web campaign against Dewhurst.

You can find my other posts on the US Senate race here.

About those attacks on Dewhurst #TxSen

In spite of the Open Letter to Texans from the Senate Republican Caucus, people on Twitter (follow the subject tag #TxSen), Facebook and even RedState.com are still making the accusation that Lieutenant Governor Dewhurst “proposed” or “supported” a personal income tax and/or a “wage” or “payroll” tax for Texas, back in 2006. I’ve touched on the subject before, but thought I’d post a more detailed explanation.

There’s a quote all over the Internet, used to prove that the LG made a statement in favor of the income tax when in fact, the comment is taken out of context. Dewhurst was objecting to adding another burden to small businesses and start ups. Unfortunately, the original Associated Press March 30, 2006 article, “Businesses studying proposed tax structure,” by April Castro, is not available online. (A Screen shot of the first page of one newspaper that carried the article is here in pdf, but there’s no quote from Dewhurst in this part. I haven’t been able to find any online version carrying the supposed quote.) However, here’s a summary from Politifacts debunking of the claim;

A March 30, 2006, AP news article, headlined “Businesses studying proposed tax structure,” indeed quotes Dewhurst as saying: “I think I’d rather see a tax that’s based on income — you earn money, you pay something, you don’t earn money, you don’t pay anything.”

We can see why a critic would single out that comment, though the full AP story indicates that Dewhurst was speaking to the particulars of revamping the business franchise tax rather than advancing his desire to create a personal or business income tax.

The story initially points out that lawmakers had previously stumbled over how to restructure the business tax, which most corporations did not owe. “They worried that proposals would not apply equally to different business structures,” the article says. “And business-friendly Republicans have been hesitant to levy a new tax that could be harmful to job creation and economic growth.”

According to the story, the consensus proposed fix — which was a plan devised by a panel headed by John Sharp, a former Texas state comptroller — would tax businesses on a percentage of their gross receipts, meaning the money a company brought in before expenses, with each company choosing between deductions for cost of goods sold or employee benefits like salary and health care. The story says sole proprietors and general partnerships would be exempt, along with companies that have annual gross receipts of $300,000 or less.

For more than 80 years, the story says, the state’s main business tax had been based on a company’s net assets, though lawmakers changed it in 1991 to make it more like a corporate income tax. Texas companies subsequently had the choice of paying either 0.25 percent of the value of their net assets or 4.5 percent of their net corporate income, whichever was greater, according to a 2003 report on Texas taxes by the nonpartisan House Research Organization.

The LG’s comment was in fact made in opposition of one idea floated during the 2005/2006 update of Texas’ 100 yr old tax business franchise tax, so that all businesses, whether they made a profit or not, had to pay on gross receipts.

In order to lower property taxes and comply with a Federal Court ruling that allowing local school districts to max out the property tax was a de facto State income tax, Governor Perry named an independent Commission in 2005, under the leadership of John Sharp, a fairly conservative Democrat. (Texas has a lot of those as well as left radicals.)

Before, there had been a lot of loopholes and exempted businesses, so that only 6% of businesses paid at all.. When the franchise tax was broadened to include nearly all businesses in Texas, lots of ideas floated around. It took a couple of years, but the final tax ended up with an exemption of the first $150K and then the next session amended that to the first $300K.

Another claim – currently seen in Cruz’ TV ads – is that Dewhurst “actively supported” a “payroll tax” during this process. Cruz cherry picks two words from a Press Release issued by the Dewhurst staff in 2006. One Senate version of the franchise tax rework praised the Senate for passing a bill that included School finance and the business tax changes. The term is only used once, in paragraph 4 and is not actually in the Bill. There are quotes around the statements by Dewhurst, but no quotes are found in the part that uses the words “payroll tax.” The Press Release notes that businesses had the option to choose between the two ways to calculate that tax, one based on income alone and one adjusted by employees payroll with exemptions, but doesn’t advocate one way over the other. (That version never passed into law.)

Attorney General Abbott successfully defended the tax against a lawsuit claiming that the franchise tax was an income tax on sole proprietorships and small partnerships in August, 2011, and the ruling from the Texas Supreme Court was reported in November, 2011.

Medicaid Expansion Would Cost Everyone

Bravo to Governor Rick Perry for refusing to move ahead on the Medicaid expansion requirements in the misnamed “Affordable Care Act,” AKA “ObamaCare.”

According to the Texas Public Policy Foundation, of the 6.5 million uninsured in Texas, fewer than 10% of Texas’ uninsured would benefit from expanding Medicaid to everyone at 133% of the Federal poverty guidelines. ObamaCare has no requirements other than annual income. The law won’t allow asset verification or take into account beneficiaries’ willingness and ability to work.

Texas uninsured numbers include Nearly 1/3 that are illegal aliens, about 40% who earn more than $50,000 a year, and about 1/4 who are already eligible under Medicaid and CHIP. None of these people would be eligible under the expansion. Many are young and healthy, not convinced they need to spend their money on insurance, anyway.

The cost of expanded Medicaid, much less the rest of Obamacare, would require increased taxes, overt and hidden, on everyone. Sure, for two years, the Federal government is supposed to “pay” for the 10% of Texas’ uninsured added to the expanded Medicaid. But it won’t pay for that 25% of uninsured that are already eligible and it won’t cover illegal aliens or “the working poor.” And after 2 years, the Federal money goes away, leaving Texas with the bill.

Even though Washington can print paper money, the government doesn’t have any money that it doesn’t take in taxes. The cost is not just what is collected by the IRS, it comes in the loss of value of the money and assets we earn or already have. Obamacare, and the Stimulus before it, are sold by the Left as a classic take-from-the-rich “redistribution of the wealth.” However, hey also cost non-taxpayers and the working poor and middle class by the harm they do to our economy and the increase in cost of necessities. As well as inevitably rewarding those who are unwilling to fend for themselves, they punish everyone who lives pay check to paycheck as well as the “wealthy.”

Governor Rick Perry tells Obama Admin, “No!” #TxSen @GovernorPerry

Governor Rick Perry has made it official: Texas won’t expand our Medicaid to cover all adults up to 133% of the Federal Poverty level. The ACA Medicaid expansion does not allow any requirements other than income. No need to work, no asset limits, no medical need or other hardship.

Here’s the Press Release from the Governor:

July 9, 2012

Gov. Rick Perry, in a letter to U.S. Health and Human Services Secretary Kathleen Sebelius, today confirmed that Texas has no intention of implementing a state insurance exchange or expanding Medicaid as part of Obamacare. Any state exchange must be approved by the Obama Administration and operate under specific federally mandated rules, many of which have yet to be established. Expanding Medicaid would mandate the admission of millions of additional Texans into the already unsustainable Medicaid program, at a potential cost of billions to Texas taxpayers.

“If anyone was in doubt, we in Texas have no intention to implement so-called state exchanges or to expand Medicaid under Obamacare,” Gov. Perry said. “I will not be party to socializing healthcare and bankrupting my state in direct contradiction to our Constitution and our founding principles of limited government.

“I stand proudly with the growing chorus of governors who reject the Obamacare power grab. Neither a “state” exchange nor the expansion of Medicaid under this program would result in better “patient protection” or in more “affordable care.” They would only make Texas a mere appendage of the federal government when it comes to health care.”

Gov. Perry has frequently called for the allocation of Medicaid funding in block grants so each state can tailor the program to specifically serve the needs of its unique challenges. As a common sense alternative, Gov. Perry has conveyed a vision to transform Medicaid into a system that reinforces individual responsibility, eliminates fragmentation and duplication, controls costs and focuses on quality health outcomes. This would include establishing reasonable benefits, personal accountability, and limits on services in Medicaid. It would also allow co-pays or cost sharing that apply to all Medicaid eligible groups – not just optional Medicaid populations – and tailor benefits to needs of the individual rather than a blanket entitlement.

Gov. Perry has consistently rejected federal funding when strings are attached that impose long-term financial burdens on Texans, or cede state control of state issues to the federal government. In 2009, Texas rejected Washington funding for the state’s Unemployment Insurance program because it would have required the state to vastly expand the number of workers entitled to draw unemployment benefits, leading to higher UI taxes later.

In 2010, Gov. Perry declined “Race to the Top” dollars, which would have provided some up-front federal education funding if Texas disposed of state standards and adopted national standards and testing.

To view the governor’s letter to Secretary Sebelius, please visithttp://governor.state.tx.us/files/press-office/O-SebeliusKathleen201207090024.pdf.

A Fourth of July Comment on ObamaCare (revised)

“We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness.–That to secure these rights, Governments are instituted among Men, deriving their just powers from the consent of the governed, –That whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or to abolish it, and to institute new Government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to effect their Safety and Happiness.”

“We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness.–That to secure these rights, Governments are instituted among Men, deriving their just powers from the consent of the governed, –That whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or to abolish it, and to institute new Government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to effect their Safety and Happiness.”

The discussion about reversing the trend from collecting taxes that are spent on individuals, rather than on common use, is considered by some as revolutionary as the July 4, 1776 Declaration of Independence. Along with everyone else, I’ve been giving a lot of thought to this in light of last week’s Supreme Court decision on the Affordable Care Act, or Obamacare. As with any law or tax, the conversation about “ObamaCare” must begin with the basics of the Declaration of Independence and the Constitution of the United States.

A decade after the Declaration of Independence, the Founding Fathers wrote the Constitution of the US to “secure” the inalienable rights of the people from infringement by the government and to prevent the growth of interference by government except where necessary to prevent or punish the infringement of inalienable rights. The Constitution included a way to make changes that the People find necessary through the Amendment process. We can’t allow anyone, whether the United Nations, the World Health Organization, or “progressives” to fundamentally alter our Constitution by law, legal ruling, or bureaucratic regulations without going through the proper, Constitutional, amendment process.

The inalienable rights to life, liberty and the pursuit of happiness carry through to all aspects of life, whether it’s working for day to day expenses, saving for the future, or making choices of foods to eat and entertainment. Rights create a non-delegable duty of personal responsibility, which means that each of us must pursue happiness for ourselves without infringing on anyone else’s rights. We cannot kill, enslave or limit others’ pursuit of happiness by forcing them to do our will or give us their property. This is true even when we face consequences that aren’t the result of our choices: accidents, natural catastrophes, bad luck or bad genes. If it makes you happy, you can freely give what you want to charity or service for the benefit of others, but even this is limited by the fact that your rights are inalienable: i.e., you can’t give away or sell your right to life or liberty.

One way that people exercise personal responsibility is to purchase insurance. Traditionally, insurance covered unexpected or catastrophic costs. There is no Constitutional justification – and certainly no economic justification – for the Federal government to turn health insurance into tax funded pre-paid “health care coverage” to pay for everything from first dollar.

When the People agree that a given purpose will secure what the Constitution calls our “Safety and Happiness,” we have allowed our governments to tax us for “public goods,” like roads, education, and defense. Social Security and Medicare are different, in that individuals were taxed and told that the money would be used for their own and their family’s future needs, rather than for common use.

After the passage of the Social Security Act in 1935 precipitated a near-Constitutional crisis, these funds were spent over the years by subsequent Congresses. They were also used to justify more taxes and spending for other people and purposes; what we now call “redistribution of wealth”. Bit by bit, good-hearted Americans have allowed the scope of both State and Federal entitlements to grow until more than half of our population receives tax funds paid by other people for food, housing, healthcare and even free cellular phones. And then came the Affordable Care Act or “ObamaCare,” which will “tax” or penalize every American if they don’t purchase government approved health insurance.

Obviously, our Nation shouldn’t break the contract with all of the people whose payroll taxes were collected over the years for Social Security and Medicare. However, the Accountable Care Act is the latest step toward the unconstitutional federalization of an industry in a way that wasn’t envisioned by the Founders of our Nation for ANY industry. What better time to evaluate Constitutional taxes and spending than Independence Day ?

Medicine vs. “Health”

Medicine is the diagnosis and treatment of disease and injury, while the World Health Organization defines “health” as “a state of complete physical, mental, and social well-being and not merely the absence of disease or infirmity.”

Doctors practice medicine, but is “health” even possible?

The hassle factor in “health care” costs

Most docs know the history of medical finance and the creep of health care payments with tax dollars. We know that the costs of chronic, much less catastrophic, health care are high. Nevertheless, most doctors look at history and know that changes in government health policies will likely mean that we will be burdened with regulations and that any talk about “savings,” means a cut in pay for what we do, on top of increased regulations.

At least as often as I hear complaints about payment for our services, docs express urgent concern that aren’t able to care for our patients due to limitations on services, requirements for prior authorizations with limited, sometime under qualified, personnel approving necessary treatments, limitations on numbers of prescriptions per month, and the inability to find sub-specialists when patients need them. And that it is only going to get harder. In my opinion, the “hassle factors” introduced by bean-counters and government bureaucrats are responsible at least as much for the increase in costs as increased definitions of health and improved technology.

A well-known cliché’ about of the cost of regulations is the ridiculous bill for an aspirin in the hospital. My own experience with regulations is another example. In 2003, when HIPAA came into force, requiring compliance, the vendor for my billing software wouldn’t support my old Linux software. They demanded that I buy the new Windows program, requiring all new computers, with the resulting cost of installation, training and the inevitable lag (and error) in billing. At least for some of us, there comes a point when the hassles aren’t worth borrowing the money to keep the office open.

Extrapolate these cascades of costs across the entire system and add in the regulations we know about, much less the ones we don’t know about – yet. Who can calculate the true cost of the Federalization of medical care?

New England Journal of Medicine: “The Health Care Jobs Fallacy”

Attempts to justify increasing intrusion of the Federal government into health insurance and health cost distract from the purpose of the practice of medicine, which is to treat patients.

Remember when doctors talked about “medical care” of individuals, not “health care” for populations?Remember when medicine was an “art,” not an “industry?” People aren’t machines with interchangeable parts and neither medicine nor “health care” are amenable to assembly line production, except in very rare instances.

The bottom line is that employment in the health care sector should be neither a policy goal nor a metric of success. The key policy goals should be to achieve better health outcomes and increase overall economic productivity, so that we can all live healthier and wealthier lives. Our ability to ensure access to expensive but beneficial treatment is hampered whenever health care policy is evaluated on the basis of jobs. Treating the health care system like a (wildly inefficient) jobs program conflicts directly with the goal of ensuring that all Americans have access to care at an affordable price.

Ted Cruz Debates Dan Patrick (#TxSen)

“Every time I go on the radio, you ask the questions that the Dewhurst campaign want you to ask.”

This, from the guy who got caught red-handed trying to influence debate questions by a fellow candidate in order to team up against Lt. Governor Dewhurst!

Listen to the radio confrontation between Ted Cruz and Texas Senator Dan Patrick on Patrick’s “The Bell and Patrick” radio show, for yourself:

Mr. Cruz argued with Patrick for 30 minutes on the Baker and Patrick Radio Show that airs on KSEV radio in the Houston area at 4 PM, week days. He unfortunately began with the flat statement that Senator Patrick had endorsed Dewhurst in the Senate race. You would think that a man would know that sort of thing, right? As Patrick said, if he’d done so, it would be public knowledge.

Cruz actually claimed that all Republicans and Democrats play a “game” with legislation they don’t want to pass, by entering into a conspiracy to pass a bill in one chamber in Session, and then in the other the next, but cheat to keep them from passing to law.

Senator Patrick spent quite a bit of time explaining the complicated workings of the Texas Senate, especially the work on the Sanctuary Cities Bills (SB 29 and HB 41) during last Summer’s Special Session of the 82nd Texas Legislature.

The two discussed the “Rose Bush Rule,” which requires 21 members of the Senate to vote in favor of bringing any issue up for a vote. Patrick reminded Cruz that the Senate members, not the Lieutenant Governor, vote on the rules of the Senate. Patrick also explained that the Lieutenant Governor has the authority to suspend that rule in a Special Session, but not in a Regular Session.

Cruz asked Patrick whether Patrick would have been able to pass Sanctuary Cities if he had been Lt. Governor. Patrick said, “No,” because “the only thing you can do is pass it out of the Senate.” Patrick said that Dewhurst had warned the Democrats in the Regular session that if they blocked the bill in the Regular Session, he would suspend the 21 vote rule in the Special Session. Patrick reported that Dewhurst did suspend the rule as he said, in order to pass the Sanctuary Cities Bill with over two weeks left in the SS and spoke of the frustration of having the Bill sit in Committee in the House.

He also told Cruz that all 19 Republican Senators had met on the issue and decided to pass SB29 as a separate Bill, rather than to try to tack HB41 as an amendment to the School Finance Bill. They were concerned that the school funding bill would be held up, preventing schools from knowing their budget until August.

Cruz ignored Patrick’s admonition to campaign on his own merits and plans, returning again and again to statements about what people “intend,” “know,” or ” believe.” Cruz accused Patrick and others of working against him, assigning underhanded motives to them, such as how much “better” for Patrick it will be to get Dewhurst out of Austin.

The creepiest bit of Cruz’ argument was this line, delivered with a strategic lowering of the voice at the last: “You have been acting as a surrogate for Lt. Gov. Dewhurst and I have seen you do it.”

I’ve described Cruz’ reactions to me when I was still a supporter asking him to cut back on the negative campaigning. At our County forum in February and then in New Braunfels. At the New Braunfels meet, he couldn’t walk away so he engaged me in debate. He kept coming at me for twenty minutes although others had questions.

Here’s a news report about another episode of over-reacting to questioning by another woman in Fort Worth at the RPT convention.

Cruz is not a “fighter” in any good sense of the word. Rather than a champion or defender, he’s a bully and a brawler. When faced with even mild opposition, he goes out of his way to prove the other person absolutely wrong. As Patrick said, he can “make numbers lie,” and has no problem with stretching the truth if it has what he calls “a basis in fact.” He sprinkles his speeches with dramatic descriptions of imagined conspiracies such as the ones above, and the notion that “Austin” Republicans had all agreed to make sure that “no one with a ‘z’ in his name is elected to State-wide office.”

For other summaries of the episode, each with their own twist, see the Houston Chronicle and Texas Tribune. But listen to the actual recording if you want the real story.

Penumbra of a tax

It’s not tax enough to invoke the Anti-injunction Act of 1987, but it will be collected by the IRS so it’s a legal, Constitutional, tax?

Maybe it’s just a shadow of a tax?

The Roberts decision on the mandate to purchase health insurance, is more confusing to me than most legal decisions. I keep looking for a way to untangle what appears to be circular contradiction, rather than logic. Here’s the best summary I’ve found that seems to say that the money the IRS collects is a tax, not a penalty for breaking the law:

Such an analysis suggests that the shared responsibility payment may for constitutional purposes be considered a tax. The payment is not so high that there is really no choice but to buy health insurance; the payment is not limited to willful violations, as penalties for unlawful acts often are; and the payment is collected solely by the IRS through the normal means of taxation. Cf. Bailey v. Drexel Furniture Co., 259 U. S. 20, 36–37. None of this is to say that payment is not intended to induce the purchase of health insurance. But the mandate need not be read to declare that failing to do so is unlawful. Neither the Affordable Care Act nor any other law attaches negative legal consequences to not buying health insurance, beyond requiring a payment to the IRS. And Congress’s choice of language—stating that individuals “shall” obtain insurance or pay a “penalty”—does not require reading §5000A as punishing unlawful conduct. It may also be read as imposing a tax on those who go without insurance. See New York v. United States, 505 U. S. 144, 169–174. Pp. 35–40.

Many of us have complained that laws and regulations have become too complicated, that no one can keep up or even avoid inadvertently breaking laws here and there. But this law is even worse because it forces action and taxes or penalizes the failure to act according to the Government’s determination of what is for our own good, rather than punishing an action or inaction that infringes on the rights of another.

To repeat hundreds of others, including the Justices who wrote the dissenting report, what are the limits of the Government once it can charge me for not doing some act?

All I can say is, vote to overturn the ObamaTax.

@DavidHDewhurst and the “Payroll Tax” Press Release (False Charge)

During the Friday night televised debate between Lieutenant Governor David Dewhurst and Ted Cruz, Cruz asked the Lieutenant Governor whether he had ever “supported a payroll tax.” The Lt. Governor answered “No.” This “When did you stop beating your wife” tactic has been the subject of much crowing from Cruz supporters who accuse the LG of lying.

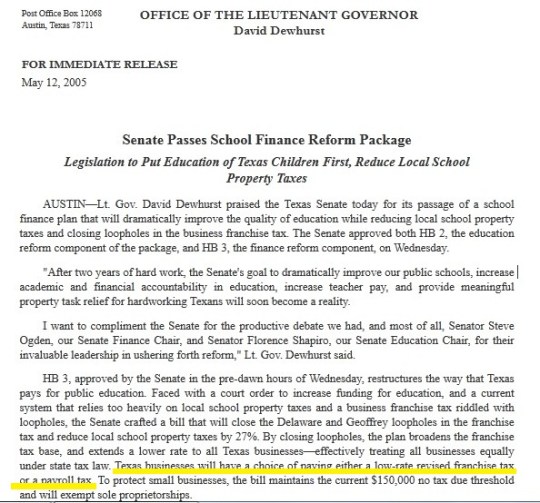

In fact, the LG was telling the truth and the whole issue is baseless spin, resulting from cherry picking two words out of hundreds in a Press Release from May 12, 2005, reproduced in part, here:

That highlighted sentence says, “Texas businesses will have a choice of paying either a low-rate revised franchise tax or a payroll tax.”

The LG definitely praised parts of HB 2 and HB 3, but the release doesn’t mention “payroll tax” until a brief note in the 4th paragraph about alternatives for calculating the tax owed by the businesses.The word “payroll” is not found in the Bill passed out of the Senate. It is not found in “quotes” in this document, so is not part of a statement made by the Lt. Governor.

The falsehoods don’t stop there. Early last Fall, Cruz has used a Wall Street Journal editorial to blur the line between the Business Franchise Tax and a State “income tax.” Editorials are simply opinion, they are not news reports and are not sufficient evidence of anything except someone’s opinion.

Cruz himself, admitted in New Braunfels last month that the “payroll tax” is in reality a hundred-years-old business tax and that he knows that Attorney General Greg Abbott successfully defended against the claim that it is an income tax on businesses, in front of the Supreme Court last November. Anyone who wants to understand the tax, could just read the AG’s response to the lawsuit, submitted to the Court in August, 2011.

Cruz’ supporters go even farther than Mr. Cruz and claim over and over on Twitter and in blogs that the LG supported or proposed not just a “payroll tax,” but a “personal income tax.”

Neither the “gotcha” question from Mr. Cruz nor this press release is something that the Cruz campaign should have based its criticism on. It certainly is not support for the false claims – beginning in the Fall of 2011 – that Lieutenant Governor David Dewhurst supported either a “payroll tax” or an “income tax.”

Lt. Governor David Dewhurst: A Record of Results

Why do I support David Dewhurst for Texas Senator?

From the Preamble to the 2010 Platform of the Republcan Party of Texas: The embodiment of the conservative dream in America is Texas.”

The result of conservative government in Texas is clear. Our State’s direction with the leadership of Lt. Governor David Dewhurst and Governor Rick Perry is a Conservative example for the Nation. Their policies and achievements demonstrate the results of action based on the belief that true liberty is Pro-life, Pro-Family, Pro-business, holds the line on taxes, spending, torts, and Washington, DC interference and regulation.

Texas leads the Nation in the creation of jobs. Our unemployment rate went down to 6.9% in May, in spite of legal US immigrants that average close to a thousand a day. Lt. Governor Dewhurst has balanced our budget in Texas, even when it meant cutting $10 million in 2003 and $15 million in 2011. In fact, the 82nd Legislature cut Texas’ dollar amount spending below the previous biennial amount for the first time since WWII. Adjusted for inflation and population, Texas spends less than when Dewhurst took office.

And there is no contest when it comes to legislative victories on social issues. Texas’ Defense Of Marriage Act was passed not once but twice under Lt. Governor Dewhurst; the second time amended our State Constitution. Thanks to his leadership, Texas passed our own Prenatal Protection Act and the “Woman’s Right to Know” informed consent law in 2003. This year, we not only added sonograms to the informed consent law, we also managed to move all of our State health care funding away from abortion providers and any of their corporate affiliates. Yes, that’s right, Texas de-funded Planned Parenthood.

The 2011 Texas 82nd Legislature was also incredibly effective on protecting our State’s borders and Sovereignty; banning drivers’ licenses for illegals, getting Voter ID, allocating $400Million for border security, and changing the law to allow Texas authorities to turn illegal aliens over for timely deportation after they’ve served their jail time. And yet, Lt. Governor Dewhurst’s opponents ignore these victories, claiming that the Lieutenant Governor “killed” two Bills in 2011: the Transportation Security Agency Anti-Groping Bill and the Sanctuary Cities Bill. However, both the TSA and Sanctuary Cities Bills were passed by the Senate at different times. The problem was coordination with the House, where the Speaker refused to allow timely consideration of the Bill and opposition by some strong conservatives, including Steve Hotze and Norm Adams. In the Special Session, the TSA bill was passed by the Senate, along with the biennial budget and a landmark omnibus medical finance bill.

In fact, even the “failed” passage of the TSA Bill in the Senate during the 82nd Legislature’s Regular Session was an example of the power of Dewhurst. He is said to have “twisted arms,” along with Governor Perry, to get the vote to the floor, even going so far as to try to “suspend the rules” to bring it up out of order. The Democrat Senators block-voted to prevent the 2/3 vote necessary while every single Republican voted for it. It is likely that had the Lt. Governor not pushed for the suspension of the rules on the TSA Bill, the budget would have passed in the Regular Session if it hadn’t come down to the midnight filibuster by the Dems.

Finally, I support Lieutenant Governor Dewhurst because he’s proven that he believes that “The government has no money, it’s the people’s money.”

Ted Cruz, Pit of Vipers, and the Council on Foreign Relations member in his family. (Updated)

Clarification, June 15, 2015 Please note: This article is about the disingenuous nature of several rants by the then-candidate in which he called the CFR “a pit of vipers” and “a pernicious nest of snakes,” without mentioning that his wife was a 5-year member of the Council until June, 2011 as part of her job for the Bush administration. The point is not the CFR or Mrs. Cruz’ job, but rather Mr. Cruz’ theatric performance, which would have been more honest if accompanied by more information.

I was researching a rumor that I read that Ted Cruz’ wife was a member of the Council on Foreign Relations until June, 2011 and that she was a Vice President at Goldman Sachs. I was curious how such a young woman could become a member of the CFR, an organization that I assumed only admitted (old) heads of State and incredibly powerful business interests.

I found this CFR Task Force report, “Building a North American Community,” which lists Heidi Cruz as a member of the Task Force which “applauds the announced ‘Security and Prosperity Partnership of North America,’ but proposes a more ambitious vision of a new community by 2010 and specific recommendations on how to achieve it.” The news release also notes that Mrs. Cruz worked for Condyleeza Rice in the Bush White House National Security Council and had been a banker at Merrill Lynch and J. P. Morgan.

Just wow! Mrs. Cruz is much more accomplished than I’d imagined.

Further searching yielded this bit of video from Ben Smith’s October 27, 2011 blog at Politico. (There’s a break in the middle, indicating editing and the source is not “conservative,” but that’s Ted saying what he’s saying. The title is also Politico’s.)

Smith comments,

Ted Cruz, the former Texas solicitor general and tea party favorite for the Republican nomination for Senate, has been focusing some of his harshest campaign trail rhetoric on that longtime villain of those suspicious of U.S. internationalism: The Council on Foreign Relations.

The New York-based group, Cruz said at a speech to a Republican women’s group in Sugarland, Tex., last week, is “a pit of vipers.”

When asked about the Council at another event in Tyler, Tex., on Oct. 15 — Texas, home of Ron Paul and Alex Jones, is the sort of place this comes up a lot — Cruz called the organization “a pernicious nest of snakes” that is “working to undermine our sovereignty,” according to video provided by someone who opposes his candidacy.

Well, Cruz should know: The candidate’s wife, Heidi S. Cruz, was an active member of the Council on Foreign Relations until this June. She was a member until June on a 5-year “term membership” program, an official at the organization confirmed.

The video and Cruz’ comments are commented on in several news and blog sites on the ‘Net, so I don’t know how I missed it and Cruz’ play-acting for his East Texas audience.

Devore: How California’s budget blunders led to my divorce from the Golden State | Fox News

Chuck DeVore, former California Assemblyman has moved to Texas and sings our praises, while pointing out the pitfalls of statist California:

Texas’ bureaucracy, excluding teachers, is 22 percent smaller as a portion of the population than is California’s, with every Texan paying about $467 a year for government retiree benefits, compared to California’s $1,105 in pension costs. Sky-high benefits for bureaucrats may soon cause the bankruptcy of Stockton, California’s 13th-largest city.

California has more government paper-pushers but Texas has 17 percent more teachers per capita, with educational outcomes favoring the Lone Star State. In fact, Texas K-12 schools perform consistently above the national average across age, racial, and subject matter areas, while California schools perform well below the national average.

To support its bloated government, California asks more of its taxpayers who pay 10.6 percent of their income to state and local government, above the U.S. average of 9.8 percent. Texans pay only 7.9 percent.

via How California’s budget blunders led to my divorce from the Golden State | Fox News.

Judge keeps Planned Parenthood out of Women’s Health Program

What happened: Texas passed a law last summer, SB 7, that specifically said that if the State is forced to give money to “entities that affiliate with abortion-promoting entities,” the State would shut down the Women;s Health Program. The Obama Administration tried to force the State to violate this law. Then, a Federal Judge ruled that the law couldn’t go into effect,

U.S. District Judge Lee Yeakel on Monday granted a preliminary injunction to require the state to keep Planned Parenthood in the program until he makes a decision on the merits of the case.

But Texas Attorney General Greg Abbott’s office asked the 5th U.S. Circuit Court of Appeals for an emergency stay of the injunction, which was granted by Judge Jerry E. Smith.

via Judge keeps Planned Parenthood out of Women’s Health Program – San Antonio Express-News.

If the injunction had stood, there would be no Women’s Health Program in Texas. Planned Parenthood seems to think that if their corporation can’t have money, no one should. Luckily, Judge Smith understood the emergency.

Planned Parenthood wasn’t hard to replace. WingRight reported on the thousands of other doctors and clinics that participate in the WHP and how to find one in your area, here.

Update, 8 AM May 2:

The attacks are on against Judge Smith.

More at the usual suspects like the Texas Tribune.

Funny, the TT doesn’t take this opportunity to link to its own interactive map showing other providers or to link to Obama’s $61 million dollar grant to Texas public health clinics.

Health Care spending continues to fall

National Review’s James C. Capretta comments on the attempts by some in the Obama Administration would like to take the credit for the decrease in health care spending in 2009-2010.

The decrease in spending follows the previous curve,according to the data.

In addition, we docs haven’t had a real increase in Medicare pay in years. We waited for Medicare to – and find out how much they would – pay us 3 or 4 times in 2010, thanks to the planned, threatened and repeatedly deferred “Sustainable Growth Rate” doc pay cuts.. Then, there was the planned moratorium at the end of the Federal Fiscal year.

As the Dems ramped up their plans for “reform,” the cuts and deferred payment were reinforced by threats of more if organized medicine didn’t play ball. I reported on the threats at LifeEthics.org in October, 2009.

Obama Administration Overturns Congress, $192M to Palestinian Authority

The US House and Senate specifically denied these funds. I’m assuming that Obama signed the Bill into law. But, what’s law got to do with it?

HotAir.com reported on an article detailing instructions from the White House to Secretary of State, Hillary Clinton, on how to report to Congress about the funds.

. . . In signing the waiver, Obama instructed Clinton to inform Congress of the move, on the grounds that “waiving such prohibition is important to the national security interests of the United States.”

The Department of State, Foreign Operations and Related Programs Appropriations Act of 2012 contained a provision that said none of the funds “may be obligated or expended with respect to providing funds to the Palestinian Authority.”

In November, the US Congress released $40 million but the State Department had expressed concern about being able to provide the necessary funding to address the dire economic and humanitarian hardship facing Palestinians.

More explanation from the UPI:

Obama cited his authority under section 7040(b) of the Department of State, Foreign Operations and Related Programs Appropriations Act of 2012 section 7040(a) of the Act, to provide appropriated funds to the Palestinian Authority.

. . . House Foreign Affairs Committee Chairwoman Ileana Ros-Lehtinen, R-Fla., had questioned the Obama administration’s request for $147 million for the Palestinian Authority at a time when P.A. President Mahmoud Abbas has demanded preconditions for returning to the negotiations while also pushing a unilateral statehouse plan at the United Nations. She also expressed concern that $26.4 million had been requested for projects in Hamas-run Gaza.

“The administration also says we need to help ‘rebuild the Palestinian economy’ — this at a time when our economy is facing serious challenges and Americans are suffering,” Ros-Lehtinen said.

On “Tax Day”

How’s your tax return? A lot of hope, no change?

Did you over-pay and get back money – without interest – you could have been using all year long? Did you underpay and now have to scramble to make a payment — or face fines and interest that the IRS sure won’t pay you if the tables were turned?

Or are you one of the lucky few who had to make “quarterly estimated tax payments” in addition to your tax return? Yes, that’s right: if you look like you might owe more taxes than most people, the IRS forces you to pay up front, every 3 months. Still without any promise of interest if you over-pay.

Vote in the Primaries and in November like your life depended on it!

The Big Lie, Buffett Version

No matter how often it’s repeated, it’s a lie that the

No matter how often it’s repeated, it’s a lie that the

Buffett rule will cut deficit or increase the money available for

Washington, DC to spend. The highest I’ve seen is $47 Billion dollars

over 10 years in revenue from the Buffett tax increase. That’s less

than one day of current *deficit* Federal spending.

The entire premise is a lie. The capital gains taxes are taxed at the

corporate rate prior to bring dispersed to investors. And they’ve

already been taxed as income from the investors.

Taxes are punishment for achievement and investment. The Buffett rule

– while sparing Buffett’s own tax shelters, the foundations run by his

kids – is a disincentive for investors and punishment for the risk

required to achieve.

For more information – proof of the Big Lie – on the rates and the amounts that “the rich” pay in taxes, take a look at what the Congressional Budget Office says about taxes and income levels:

- “The overall federal tax system is progressive—that is, average tax rates generally rise with income. Households in the bottom quintile (fifth) of the income distribution paid 4 percent of their income in federal taxes, while the middle quintile paid 14 percent, and the highest quintile paid 25 percent. Average rates continued to rise within the top quintile, with the top 1 percent facing an average rate of close to 30 percent.

- “Higher-income groups earn a disproportionate share of pretax income and pay a disproportionate share of federal taxes. In 2007, the highest quintile earned 56 percent of pretax income and paid 69 percent of federal taxes, while the top 1 percent of households earned 19 percent of income and paid 28 percent of taxes. In all other quintiles, the share of federal taxes was less than the income share. The bottom quintile earned 4 percent of income and paid less than 1 percent of taxes, while the middle quintile earned 13 percent of income and paid 9 percent of taxes.”

ObamaCare Morbity and Mortality Conference

Reading the transcripts of the three days of Supreme Court hearings (Day 3 is here) on Obamacare is enough to make me scream in frustration and pain at the convoluted arguments. Sometimes it seems to me as though the Court is playing games with our lives and laughing about it as though it’s an inside joke.

Why don’t they just stick to the plain reading of the Constitution and the law? Who cares about Lochner or Brock or Printz, Raich, Wickard? Why are Ginsburg and Sotomayor leading the Solicitor General?

Part of the problem is that this really is an elite group, immersed in the minutia of Court rulings that most of us have never heard of, much less read. What probably should have been a clear and easy reference by Justice Scalia, made me look up the Eighth Amendment and “cruel and unusual punishment.”

In an attempt to give the Justices and lawyers the benefit of the doubt, I’m trying to think of the hearings as a sort of “Morbidity and Mortality” (“M and M”) conference. (The other analogy had to do with zombies. Decided not to go there.)

I imagine that a layman would feel equally lost and frustrated at a M and M, watching doctors review outcomes from tough cases where something went wrong or someone died. No detail is too small or unimportant for debate and (excuse the pun) dissection, unless the attending or Chief (Justice) declares it so. Where there are rivalries or competition, the docs try to “one up” each other by the use of jargon and eponyms, correct pronunciation, obscure research and cute little “you had to be there but you weren’t so I’m brilliant/safe/top dog and you’re not” digs.

(Even here, I indulge in jargon: “eponyms” are names given to something based on the person who is given credit for the technique or discovery or some aspect of the disease or technique discussed, a sort of nickname that saves time and breath for the speaker. My theory about jargon – at least since I’ve finished residency and can’t be made to repeat a couple of months of training – is that whoever says the word loudest, is right about the pronunciation. As a Family Physician among sub- and super-sub-specialists, I want the anatomical or pathological name, not some esoteric reference to a paper in a journal or a dead guy’s name. I advise my patients to demand the same.)

Going back to the M and M: families and patients watching the conference, with our obscure references, jargon and eponyms probably would feel that the doctors and doctors-in-training don’t care as much about the patient as we do about shaming our rivals and proving and improving our own superiority and power in the group. While that may be true in some cases, the purpose – and more often than not, the result – of the process of review and debate is to make each of us more knowledgeable and to try to make sure we never make the same mistakes twice.

So when we call patients (or the hearings) “trainwrecks” we don’t really mean disrespect. The analogy is good: just as the cars on the train hit the one in front of them, go off the track, pile up each other, turn upside down and cause damage on top of damage, treatment.of very sick patients involve correcting one problem without creating another, organ failure on top of organ failure and digging through the most urgent crises before we can get to the point where we can fix what went wrong in the first place. It just looks like we don’t know what we’re doing.

Hopefully, we’re watching the Supremes review the autopsy of Obamacare rather than a debate over how much and how long to give life support. The “patient” in this case was a “trainwreck” from the beginning, but maybe Congress will learn something.

HatTip to Sonja Harris’ Conservatives in Action for the “trainwreck” link.

Best questions from Supremes on ObamaCare debate

The only thing sure in life is death and taxes. The difference is that “We the People” can avoid taxes by making sure our Republic is sound and avoid the errors that the founding fathers and de Tocqueville (and I) warned us about.

Unfortunately, our Nation has decided – whether by default or not – that a group of nine appointed Justices are not only the “highest court in the land,” they are the highest LAW in the land. And so, we find ourselves at the mercy of the whims – and sometimes the least consistent – of these justices

I’ve been scanning the transcript from the Tuesday, March 27, 2012 debate before the Supreme Court, which is available at the SCOTUS website.

A question by Justice Alito :

“All right, suppose that you and I walked around downtown Washington at lunch hour and we found a couple of healthy young people and we stopped them and we said, “You know what you’re doing? You are financing your burial services right now because eventually you’re going to die, and somebody is going to have to pay for it, and if you don’t have burial insurance and you haven’t saved money for it, you’re going to shift the cost to somebody else.”

“Isn’t that a very artificial way of talking about what somebody is doing?”

RedState.com’s Erick Erickson wrote about “Sinners in the hands of Anthony Kennedy,” and noted “the quote heard round the world,” from Justice Kennedy:

“But the reason this is concerning, is because it requires the individual to do an affirmative act. In the law of torts our tradition, our law, has been that you don’t have the duty to rescue someone if that person is in danger. The blind man is walking in front of a car and you do not have a duty to stop him absent some relation between you. And there is some severe moral criticisms of that rule, but that’s generally the rule.

“And here the government is saying that the Federal Government has a duty to tell the individual citizen that it must act, and that is different from what we have in previous cases and that changes the relationship of the Federal Government to the individual in the very fundamental way.”

Hear and read the passage, at Real Clear Politics.

Erickson points out that the media are changing the meme of the debate from whether the law is Constitutional to a rant that the Conservatives on the Court are bullying the rest. The Houston Chronicle joins the chorus and proves Erick’s point.

To think that I almost posted this without adding the Category “Media Abuse.”

Find a Women’s Health Program doctor in Texas

Planned Parenthood (“PP”) for years has used the media and fraud to bring in clients when those women could have gone to a family doctor or OB/Gyn. Below are three ways to find a local doctor who participates with the Women’s Health Program in Texas.

As a woman doctor, mother and grandmother from Texas, I support Governor Perry in his support of the law, passed once again by the Texas Legislature last summer, that prohibits any of our tax funds going to any “affiliate” of abortionists. Senate Bill 7, the huge law covering Texas medical financing, was passed in the Special Session of the 82nd Legislature and renewed a State prohibition on any Texas Medicaid funds going to “perform or promote elective abortions, or to contract with entities that perform or promote elective abortions or affiliate with entities that perform or promote elective abortions.” (See page 91.)

The Obama administration and countless media and op-ed articles would have us all believe that the law is new, but it’s not. The original Women’s Health Program (“WHP”) was created in 2005 and received a 5 year waiver from the Bush Administration in 2006, as finalized in these documents from the Center for Medicare and Medicaid Services. All of these facts are outlined in the Complaint filed by Attorney General Greg Abbott in his lawsuit against Kathleen Sebelius and Obama’s Health and Human Services:

11.From the outset of the Women’s Health Program, the Texas Legislature has explicitly prohibited taxpayer funds from going to entities that perform or promote elective abortions. The Legislature also prohibited taxpayer dollars from funding affiliates of entities that perform or promote elective abortions. See id. § 32.0248(h) (“The department shall ensure that the money spent under the demonstration project, regardless of the funding source, is not used to perform or promote elective abortions. The department, for the purpose of the demonstration project, may not contract with entities that perform or promote elective abortions or are affiliates of entities that perform or promote elective abortions.”).

Read the next few paragraphs of the Complaint for comments on dates and on approval of the waiver without restrictions on Texas’ prohibition on abortion providers. Please note that the waiver was requested in December, 2005, and approved in December, 2006, for a period of 5 years, to end December 31, 2011. It is not true, as reported by a spokesperson for Secretary Sebelius, that the waiver was denied.

Texas law prohibited State funds from going to any provider who performed or referred to elective abortions beginning in 2003. Under a provision known as “Rider 8,” the State began requiring recipients of Medicaid and Family Planning money to sign an affidavit that they did not perform or refer for elective abortions. Texas won when PP challenged Rider 8 in Federal Court. The various PP sub-corporations in the State then set up separate corporations for the “medical affiliates” that were not licensed to perform abortions and the “surgical affiliates” that did perform elective abortions. These were shams, as all of the corporations came under the direction of Planned Parenthood Federation of America and some even shared buildings and staff. It turned out that 4 of the facilities run by the PP Trust of San Antonio and South Texas didn’t even bother with the sham. They were found to be illegally performing medical abortions, and were fined and shut down in 2009 as unlicensed abortion clinics and for fraudulently billing Medicaid.

Here are a few numbers from Governor Perry’s office that show that Planned Parenthood is not the most efficient way for Texas to spend our Medicaid dollars:

- There are more than 2,500 qualified providers in the WHP.

Planned Parenthood represents less than two percent of providers in the WHP.- Planned Parenthood’s cost per client is 43 percent higher than most other providers, according to the Texas Health and Human Services Commission.

- In FY 2010, nearly 80 percent of women served received WHP services from non Planned Parenthood providers.

What did happen is that last year, Attorney General defined “affiliates.” Logically, subsidiaries of a given corporation, such as all the “medical affiliates” of Planned Parenthood Federation of America, are “affiliates” of that corporation.

PP and their supporters would have us believe that hundreds of thousands of women will go without care because of the Texas law. On the contrary, those affiliates were easily replaced. Thousands of qualified doctors and clinics already participate with the Women’s Health Program in Texas.

And there are several ways to find one of the qualified providers for the Women’s Health Program in your town:

In Texas, we have “2-1-1,” a State services telephone information line. You can call 2-1-1 from any phone to find all sorts of assistance in your area, including doctors who participate with the WHP. I’ve heard that this may not be the most up to date or complete list, however.

Texas Tribune published an interactive map that highlights the color coded stark reality of the differences in numbers and in the distribution of PP versus the many doctors who currently participate with the Women’s Health Program. Notice that Planned Parenthood only shows up where there are lots of other providers. Where there aren’t many doctors, there are definitely no PP facilities.

For the most accurate and largest number of WHP qualified doctors and clinics in your area, Texas’ Department of Health and Human Services has a search engine available here. Use the “Advanced Search,” then choose Plan type:”Traditional Medicaid,” Provider type: “Specialist” (although this will actually bring up family physicians and other primary care docs), and Waiver type: “Women’s Health Program.” You can search by County or by Zip Code.

Hopefully this information will help you answer the critics of Texas, our Legislature, Commissioner of Texas’ Health and Human Service Suehs, and our Governor Perry.

ObamaCare facts from American Doctors for Truth!!!

Watch this video!!!! American Doctors 4 Truth looks very interesting, and they certainly know how to tell the truth!

http://www.youtube.com/watch?feature=player_embedded&v=PJ-p29xEM0s

The doctors on this video tell the truth about the Independent Payment Advisory Board, ObamaCare and what we need to do!

Planned Parenthood “affiliates” and the Texas Women’s Health Program

Today, the Austin Chronicle, the local “alternative” news source, has yet another article “Perry continues assault on women’s healthcare,” claiming that Governor Perry and the Commissioner of Health and Human Services Suehs have acted – seemingly on their own – to shut down the Texas Women’s Health Program (more info here) in order to spite the poor underdog, Planned Parenthood.

Today, the Austin Chronicle, the local “alternative” news source, has yet another article “Perry continues assault on women’s healthcare,” claiming that Governor Perry and the Commissioner of Health and Human Services Suehs have acted – seemingly on their own – to shut down the Texas Women’s Health Program (more info here) in order to spite the poor underdog, Planned Parenthood.

Today’s statement is that “The new regulation signed by Suehs – redefining “affiliate” to mean that Planned Parenthood clinics not providing abortions are deemed affiliated with those clinics that do – conflicts with federal law, as confirmed last week by U.S. Health and Human Services Secretary Kathleen Sebelius.”

Actually, the Attorney General ruled on the definition of “Affiliate.” The Secretary must follow the law passed last Spring by the 82nd Texas Legislature.

It’s not surprising – in fact it’s common sense – that subsidiary corporations are considered “affiliates” by the State, since they are members of the Planned Parenthood Federation of America. The annual report of PPFA calls these facilities their “medical affiliates.” The President of PPFA, Cecile Richards, shown above with Texas Senator Jeff Wentworth at a Planned Parenthood of San Antonio and South Texas event, visits these subsidiaries in her official duties.

(Photo from the 2009 Annual Report of Planned Parenthood of San Antonio and South Texas)

Oppose theObama Standoff!

Bravo, to all the Letters to the Editors and comments in favor of religious free expression, conscience and State’s rights that I’m seeing. (My hometown paper has one from a man I don’t know – but only subscribers can read it.)

It’s been said before: if the Federal government can make you buy anything, it can make you buy *anything.* Will the mandated insurance packages in Washington include Physician Assisted Suicide?

This administration has already imposed regulations that infringe on the right of conscience of physicians and other health care providers. (“Anti-abortion” docs should never serve under-served areas and should have cooperative referral agreements with abortionists according to previous opinions by Sebelius.)

Who wants a doctor or church leader without a conscience giving you medical or spiritual care? Or even picking out what you hope is a reliable insurance company who will be there when you really need them?

In a particularly unconscionable moment, one Obama Administration representative told representatives of religious organizations that they had a year to reconcile – with Obama, not with God.